Take Control of Your Finances with a Proven Debt-Busting Guide

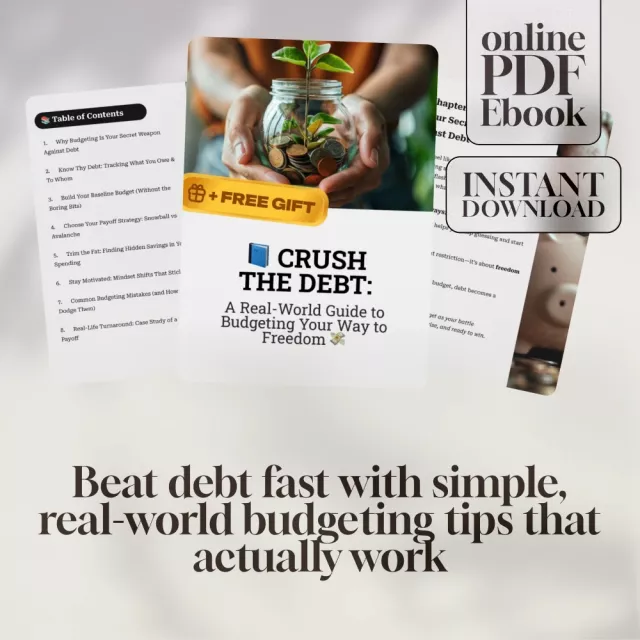

If you’re tired of feeling overwhelmed by bills and want to finally get ahead with your money, Crush the Debt: A Real-World Guide to Budgeting Your Way to Freedom is your practical, no-fluff roadmap to financial freedom. This easy-to-follow eBook is designed to show you exactly how to budget to pay off debt—even if budgeting has never made sense to you before. Whether you’re drowning in credit card balances or just want to get serious about your spending, this guide meets you where you are and helps you create a clear, confident plan to move forward.

What You’ll Find Inside

- Chapter 1: Why Budgeting Is Your Secret Weapon Against Debt

- Chapter 2: Know Thy Debt: Tracking What You Owe & To Whom

- Chapter 3: Build Your Baseline Budget (Without the Boring Bits)

- Chapter 4: Choose Your Payoff Strategy: Snowball vs Avalanche

- Chapter 5: Trim the Fat: Finding Hidden Savings in Your Spending

- Chapter 6: Stay Motivated: Mindset Shifts That Stick

- Chapter 7: Common Budgeting Mistakes (and How to Dodge Them)

- Chapter 8: Real-Life Turnaround: Case Study of a $20K Payoff

- Chapter 9: Tools, Apps, and Hacks to Keep You on Track

- Chapter 10: Next Steps: Make Your Budget Real & Rewarding

Why You’ll Love It

- Clear, real-world advice: No jargon, no guilt—just practical steps you can take today.

- Budgeting made simple: Learn how to budget to pay off debt without sacrificing your lifestyle.

- Choose your method: Compare the Snowball and Avalanche payoff strategies to find what works for you.

- See real results: Read a case study of someone who paid off $20,000 using these tips.

- Stay on track: Includes recommended tools, mindset tips, and motivation hacks.

Who It’s For

This eBook is perfect for anyone ready to get serious about their finances, especially if you’re asking yourself how to budget to pay off debt. Whether you’re just starting out, coming back from financial setbacks, or simply want a system that works in real life—not just in theory—this guide is for you.

What Makes It Different

Unlike other resources that overwhelm you with spreadsheets or unrealistic advice, Crush the Debt is straightforward, action-oriented, and designed with busy people in mind. It’s written by someone who’s been there—so you won’t find fluff or shame here, just steps you can actually follow.

Start Your Debt-Free Journey Now

Don’t wait for the “right time” to get your finances in order. Download Crush the Debt: A Real-World Guide to Budgeting Your Way to Freedom today and take the first step toward a life with less stress and more freedom. Discover how to budget to pay off debt in a way that’s realistic, effective, and empowering.

Can I cancel my order?

All orders can be canceled until they are shipped. If your order has been paid and you need to change or cancel it, please contact us within 12 hours of placing it.

Can I get a refund if something is wrong with my order?

Within 14 days of receiving the parcel, you can ask us for:

- A full refund if you don’t receive your order

- A full refund if your order does not arrive within the guaranteed time (1-3 business days not including 1 business day processing time)

- A full or partial refund if the item is not as described

Full refunds are not available under the following circumstances:

- Your order does not arrive due to factors within your control (e.g. providing the wrong shipping address)

- Your order does not arrive due to exceptional circumstances outside our control (e.g. not cleared by customs, delayed by a natural disaster).

All our products are backed with a 14-day money back guarantee. Just send us a message on the Contact Us page and we will refund the purchase price.

Can I return an item for an exchange instead of a refund?

Yes, you can! Kindly Contact Us form to discuss the details with us.

Can I return my purchase?

All our products are backed with a 14-day money back guarantee. Just contact us and we will refund the purchase price.

If you are not satisfied with your purchase, you can return it for a replacement or refund. No questions asked! You only should return it at your expense.

Please contact us first and we will guide you through the steps. We are always ready to give you the best solutions!

Please do not send your purchase back to us unless we authorize you to do so.

Are there any items I can’t return?

Hygiene and our customers’ safety is our top priority, which is why there are specific types of products that can’t be returned such as:

- Face and body products if opened, used, or have a broken protective seal

- Underwear if the hygiene seal is not intact or any labels have been broken

- Swimwear if the hygiene seal is not intact or any labels have been broken

- Pierced jewellery if the seal has been tampered with or is broken

Your files will be available to download once payment is confirmed.

There's something empowering about knowing what you owe and to whom. This guide doesn't just preach, it provides concrete steps on tracking your debt. It was a bit of a reality check for me but an essential one nonetheless.

Wow, this guide is like a personal trainer for your wallet! 🏋️♂️ The strategy of snowball vs avalanche was an eye-opener. Debt doesn't stand a chance!

Transformed my view on budgeting! It's now a tool, not a chore.

Trimming the fat from my spending wasn’t as painful as I thought it would be. Found some hidden savings and now I'm on my way to being debt-free.

This eBook is like having a personal financial coach in your pocket! The tips on staying motivated were particularly helpful - they've made me see budgeting not as a chore but as a step towards gaining control over my finances. A little more detail in some sections would be great though.

Empowering, insightful and full of actionable advice. A must-read for everyone.

I've tried budgeting before but always lost motivation. This eBook gave me mindset shifts that stick - finally feeling excited about paying off my debts! 😄

The $20K payoff case study? Inspiring stuff right there 👌 Gave me hope that if they can do it, so can I!

I can't believe how much I learned from the 'Build Your Baseline Budget' section alone! No boring bits indeed - just straightforward, practical advice that's easy to follow. Plus, the real-life turnaround story of $20K payoff? Absolutely inspiring!

A no-nonsense guide with practical tips to conquer debt. Highly recommended!